41++ Whats The Difference Between A Sole Proprietorship And An Llc Ideas in 2022

Whats the difference between a sole proprietorship and an llc Other business entities require that you file separate taxes for both your business and your personal finances.

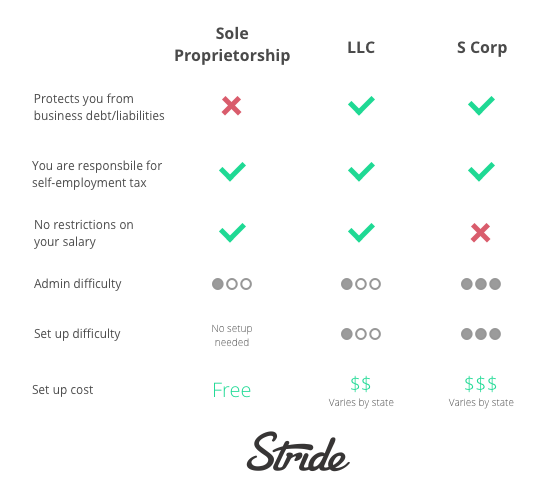

Whats the difference between a sole proprietorship and an llc. In a sole proprietorship theres no difference between your personal income and your business income. Comparatively an LLC is viewed as a separate business identity. Sole proprietorships and partnerships cannot use words like corporation or limited liability in their name. An LLC is a business entity formed and owned by one or more members. Since an LLC is a separate legal entity from its owners creditors can only go after the business assets in a dispute. So when reviewing a sole proprietorship LLC and other business structures dont rush to make a decision. The main difference is that a limited liability company owner has more upside financial and legal protection than a sole proprietor. Sole proprietorship and LLC Limited Liability Company are the most common forms of. LLCs must include limited liability company or LLC at the end of their chosen name. Whats the Difference Between a Sole Proprietorship and an LLC. The S corporation provides similar tax advantages and limits liability. Unlike a sole proprietorship whose owner is personally liable for any claims against the business an.

However it is more formal. A sole proprietor is defined by the IRS as a person who owns an unincorporated business. A sole proprietorship is an unincorporated business owned and run by one person. An LLC exists separately from its ownersknown as members. Whats the difference between a sole proprietorship and an llc The personal assets of a member are not at risk due to the liability incurred by employees or fellow members. The main difference between a sole proprietorship and an LLC is that an LLC will protect your personal assets if your business is sued or suffers a loss. LLC is a US term for private limited companies having Limited Liability. The main benefit of forming a sole proprietorship is that it is an extremely simple process and it is relatively easy to operate under this type of business structure. Since it is not considered to be a legal entity a sole proprietorship will refer to the individual who owns the business and that owner is held personally responsible for its debts. The main distinction between the two is that a sole proprietorship and the owners are one and the same while a single-member LLC provides a divide between the two in both legal and tax matters. Make sure you understand the. A sole proprietorship means a single persons business with no difference between the person and the business not involving much with the legal issues. The difference between sole proprietorship and LLC honestly comes down to one major thing.

Whats the difference between a sole proprietorship and an llc A sole proprietorship is the easiest and most basic form by which a business can be run and is subsequently not considered to be a legal entity.

Whats the difference between a sole proprietorship and an llc. Instead the LLC is responsible. Sole proprietorships have one owner while a LLC has one or more owners that may consist of corporations foreign businesses and even partnerships. LLC is separate legal entity run by its members having limited liability and it is mandatory for an LLC to get registered whereas sole proprietorship is a sort of business arm of an individual which is not separate from its owner hence its liabilities are not limited and there is no need to register sole proprietor.

Most serious business owners choose to form an LLC vs. Any person who does business but isnt registered as a corporation partnership or limited liability company is a sole proprietor by default. Choosing between an LLC or sole proprietorship can be difficult.

How to Choose Between a Sole Proprietorship and an LLC. An LLC provides the tax advantages of the sole proprietorship but limits member liability. Differences Between Sole Proprietorship and LLC.

Whats the difference between a sole proprietor and an LLC. Sure there are other things such as taxes and fees but liability is the only real difference between sole proprietorship and LLC. This is because both of these entities come with different pros and cons that can spell success or failure depending on your business.

In an LLC theres no difference between your personal income and your share of the companys profits. It is the protection an LLC business is offered that a sole proprietorship is not that makes the difference. However members are not personally responsible for business debts and liabilities.

Those who own an LLC are viewed as investors and the actions of the organization are managed by designated managers or the managers themselves. LLC stands for limited liability company where limited liability means your personal assets cant be used as collateral if your business is sued or goes bankrupt. Single-Member Limited Liability Company.

When filing a DBA there are some name restrictions based on the type of business you are. A sole proprietorship because an LLC legally separates the owners personal assets from the business.

Whats the difference between a sole proprietorship and an llc A sole proprietorship because an LLC legally separates the owners personal assets from the business.

Whats the difference between a sole proprietorship and an llc. When filing a DBA there are some name restrictions based on the type of business you are. Single-Member Limited Liability Company. LLC stands for limited liability company where limited liability means your personal assets cant be used as collateral if your business is sued or goes bankrupt. Those who own an LLC are viewed as investors and the actions of the organization are managed by designated managers or the managers themselves. However members are not personally responsible for business debts and liabilities. It is the protection an LLC business is offered that a sole proprietorship is not that makes the difference. In an LLC theres no difference between your personal income and your share of the companys profits. This is because both of these entities come with different pros and cons that can spell success or failure depending on your business. Sure there are other things such as taxes and fees but liability is the only real difference between sole proprietorship and LLC. Whats the difference between a sole proprietor and an LLC. Differences Between Sole Proprietorship and LLC.

An LLC provides the tax advantages of the sole proprietorship but limits member liability. How to Choose Between a Sole Proprietorship and an LLC. Whats the difference between a sole proprietorship and an llc Choosing between an LLC or sole proprietorship can be difficult. Any person who does business but isnt registered as a corporation partnership or limited liability company is a sole proprietor by default. Most serious business owners choose to form an LLC vs. LLC is separate legal entity run by its members having limited liability and it is mandatory for an LLC to get registered whereas sole proprietorship is a sort of business arm of an individual which is not separate from its owner hence its liabilities are not limited and there is no need to register sole proprietor. Sole proprietorships have one owner while a LLC has one or more owners that may consist of corporations foreign businesses and even partnerships. Instead the LLC is responsible.

What Legal Entity Is Best For My Company Sole Proprietorship Partnership Llc Or Corporation Lawrence Baker Esq Legal Blog

What Is The Difference Between Proprietorship Partnership Limited Liability Partnership One Person Company Private Limited Company Quora