37+ How To Determine How Many Withholding Allowances Should I Claim Ideas

How to determine how many withholding allowances should i claim. Is it better to claim 1 or 0 on your taxes. August 2019 this Fact Sheet has been updated to reflect changes to the Withholding Tool. Divide the amount specified in Step 4 a of your employee. Use the calculators to determine the number of allowances you should claim. Divide that by your total income. How Many Allowances Should I Claim if Married with 2 kids. Taxpayers can avoid a surprise at tax time by checking their withholding amount. Generally the more allowances you claim the less tax will be withheld from each paycheck. Taxpayers pay the tax as they earn or receive income during the year. If you are married with two kids you should claim three or more allowances. Use the IRS Tax Withholding Estimator to determine how much tax you can withhold. To determine how much to withhold from your paycheck your employer uses the amount of your paycheck and the information you provide on your W-4.

For example a single person with one job will claim fewer allowances than someone who is married with children. How many allowances should you claim on Forms W4. Gather the most recent pay statements for yourself and if you are married for your spouse too. Gather information for other sources of income you may have. How to determine how many withholding allowances should i claim Keep in mind that the Tax Withholding Estimators results will only be as accurate as the information you enter. To calculate how much federal income tax to withhold from your employees paychecks each pay period you can use the wage bracket method. The IRS urges everyone to do a Paycheck Checkup in 2019. This is determined by your filing status how many jobs you have and whether or not you have dependents. If you want to get close to withholding your exact tax obligation then claim 2 allowances for both you and your spouse and then claim allowances for however many dependents you have so if you have 2 dependents youd want to claim 4 allowances to get close to withholding your exact tax obligation. Knowing how to fill out your W4 depends largely on knowing how many allowances you should claim. You fill out a pretend tax return and calculate you will owe 5000 in taxes. 2 For example lets say your total income will be 20000 from a pension and 30000 that you will withdraw from your IRA. In addition to indicating whether you will file.

2021 New W 4 Form No Allowances Plus Computational Bridge

2021 New W 4 Form No Allowances Plus Computational Bridge

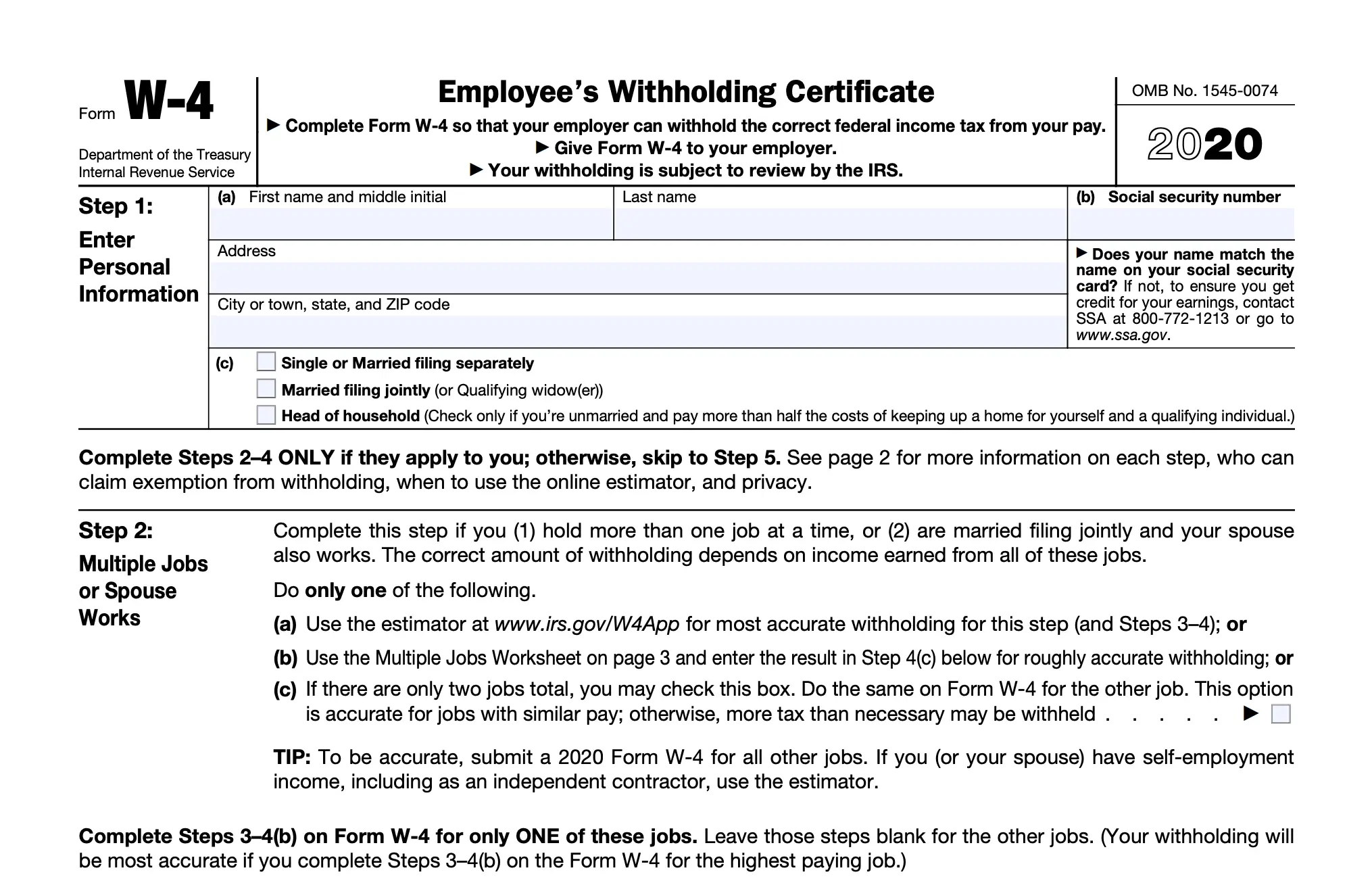

How to determine how many withholding allowances should i claim The Internal Revenue Service has Form W4 as means to help employers and payers to withhold the right amount of tax from the recipients income.

How to determine how many withholding allowances should i claim. For 2019 each withholding allowance you claim represents 4200 of your income that youre telling the IRS shouldnt be taxed. Exactly how much your employer withholds will depend largely on how much money you make and how you fill out your W-4. When filling out Georgias G-4 form the total number of allowances that you claim determines how much your employer withholds from your paycheck.

If you are wondering Should I claim 0 or 1 on W4 the number you write down on your W-4 form will no longer have a significant impact on both your paycheck during the. Keep in mind that you still need to settle up your tax liability at the end of the year by filing your tax return. After you determine the forms needed.

If you are married with one child you are allowed to claim three allowances. The W-4 instructions have three worksheets to help you determine how many withholding allowances you can claim. The fewer allowances claimed the larger withholding amount which may result in a refund.

Complete the forms and give them to your employer to make the changes. How to Calculate Withholding Allowances The W-4 instructions have three worksheets to help you determine how many withholding allowances you can claim. Dont give the worksheets to your employer The goal is to select the number of allowances that will result in total withholding for the.

If its March 31 2016 and your total withholding to date is 3000 and you are paid monthly divide the amount of withholding by the number of months. Need to adjust both your federal and state withholding allowances go to the Internal Revenue Service IRS website and get Form W-4 Employees Withholding Allowance Certificate. Complete the form properly to avoid a possible withholding shortage which can result in a penalty when you file your Georgia tax return.

How many allowances should I claim. You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form depending on what youre eligible for. Have your most recent income tax return handy.

While you can claim as many allowances as youd like it isnt going to be right for your withholding. Use the answer to see what percentage to withhold. While you used to be able to claim allowances your withholding is now affected by your claimed dependents if your spouse works or if you have multiple jobs.

How Many Allowances Should I Claim if Married With 1 Kid. FS-2019-4 March 2019 The federal income tax is a pay-as-you-go tax.

How to determine how many withholding allowances should i claim FS-2019-4 March 2019 The federal income tax is a pay-as-you-go tax.

How to determine how many withholding allowances should i claim. How Many Allowances Should I Claim if Married With 1 Kid. While you used to be able to claim allowances your withholding is now affected by your claimed dependents if your spouse works or if you have multiple jobs. Use the answer to see what percentage to withhold. While you can claim as many allowances as youd like it isnt going to be right for your withholding. Have your most recent income tax return handy. You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form depending on what youre eligible for. How many allowances should I claim. Complete the form properly to avoid a possible withholding shortage which can result in a penalty when you file your Georgia tax return. Need to adjust both your federal and state withholding allowances go to the Internal Revenue Service IRS website and get Form W-4 Employees Withholding Allowance Certificate. If its March 31 2016 and your total withholding to date is 3000 and you are paid monthly divide the amount of withholding by the number of months. Dont give the worksheets to your employer The goal is to select the number of allowances that will result in total withholding for the.

How to Calculate Withholding Allowances The W-4 instructions have three worksheets to help you determine how many withholding allowances you can claim. Complete the forms and give them to your employer to make the changes. How to determine how many withholding allowances should i claim The fewer allowances claimed the larger withholding amount which may result in a refund. The W-4 instructions have three worksheets to help you determine how many withholding allowances you can claim. If you are married with one child you are allowed to claim three allowances. After you determine the forms needed. Keep in mind that you still need to settle up your tax liability at the end of the year by filing your tax return. If you are wondering Should I claim 0 or 1 on W4 the number you write down on your W-4 form will no longer have a significant impact on both your paycheck during the. When filling out Georgias G-4 form the total number of allowances that you claim determines how much your employer withholds from your paycheck. Exactly how much your employer withholds will depend largely on how much money you make and how you fill out your W-4. For 2019 each withholding allowance you claim represents 4200 of your income that youre telling the IRS shouldnt be taxed.

Indeed lately has been sought by users around us, perhaps one of you. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the title of this article I will talk about about How To Determine How Many Withholding Allowances Should I Claim.

How to determine how many withholding allowances should i claim. How Many Allowances Should I Claim if Married With 1 Kid. FS-2019-4 March 2019 The federal income tax is a pay-as-you-go tax. How Many Allowances Should I Claim if Married With 1 Kid. FS-2019-4 March 2019 The federal income tax is a pay-as-you-go tax.

If you are searching for How To Determine How Many Withholding Allowances Should I Claim you've arrived at the right place. We ve got 51 images about how to determine how many withholding allowances should i claim including pictures, pictures, photos, wallpapers, and more. In such web page, we additionally have variety of graphics available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.